Property tax bills were mailed out August 12, 2024. Property taxes become due and payable as of September 1, with the last day to pay being January 6. After January 6, all outstanding taxes become delinquent.

In years past, taxpayers have typically received one bill for their real and personal property together. This year, our office has tried to separate all personal property from being attached to real property, so you will receive two separate bills.

What did my tax bill change so much from 2023 to 2024?

For the 2024 revaluation, this is the first time that we have reappraised properties in Wilson since 2016. NC laws require all counties to reappraise all real properties once every 8 years. Wilson is currently on an eight-year cycle. When a revaluation is conducted, we are looking at the current real estate market in Wilson, and adjust our rates based on sales, construction costs, and other factors related to the market. More information can be found on this process at the link below.

https://www.wilsoncountync.gov/departments/tax-department/2024-countywide-revaluation/revaluation-information

Market Value

When we are reviewing our different market areas, or neighborhoods, we start by analyzing the sales in the area to help determine an estimate market value for all properties.

One resource our office provides is a unique tool that will allow you compare your property with other sales of homes in your neighborhood. The sales are a good indication of the market value in your area as of January 1, 2024. Please check out our Comper for Citizen site: https://nc-wilson-citizen.comper.info/template.aspx?propertyID=3657368882 to review your area.

Real Property Appeal Process

The deadline to appeal the new valuation ended on May 16, 2024, at the adjournment of our Board of Equalization and Review. The next opportunity to appeal you real property value will begin in January 2025 for the 2025 tax year. We will be providing more educational opportunities later this year and will mail our valuation notices in January 2025.

Personal Property Appeal Process

The deadline to appeal personal property assessments and valuation is September 10, 2024 at 11:59 PM. The appeal must be submitted in writing to our office, by email, or postmarked by this date to be accepted for 2024.

I sold my real property after January 1, why am I receiving the bill?

The value, ownership, and place of taxation (situs) of real and personal property is determined annually as of January 1. Therefore, regardless of if the property sells after January 1, the tax bills are sent out to the owner of record as of January 1. In most cases, a change in ownership after January 1 will be reflected in the next tax year.

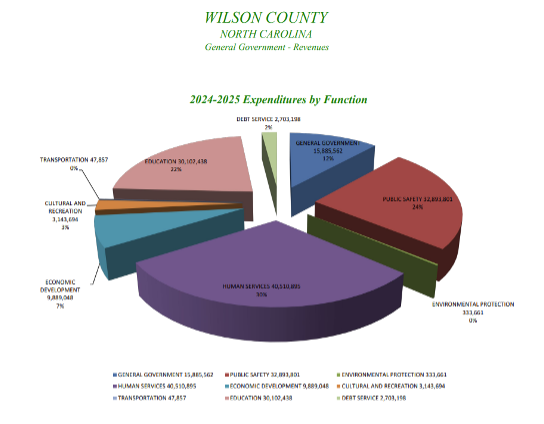

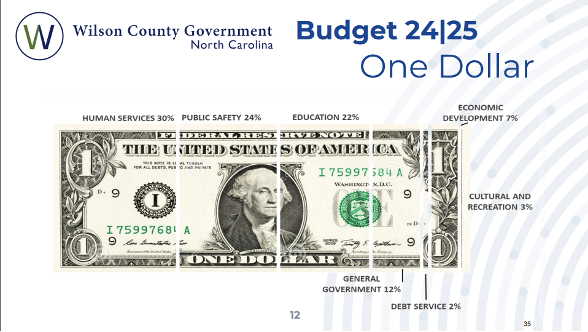

How are our tax dollars being spent?

For a full line-item breakdown of our budget, please visit the following link:

https://www.wilsoncountync.gov/home/showpublisheddocument/7414/638537931669570000

These two charts are a simple way to see how tax dollars are being spend in the county. These also match the percentages that were provided on the bills for a breakdown.